Describe Techniques Used to Analyze Customer Financial Information

Discovering their needs and their pain points. Grouping customers according to similar traits and behaviors.

What Is Financial Reporting And Analysis Learn Its Importance

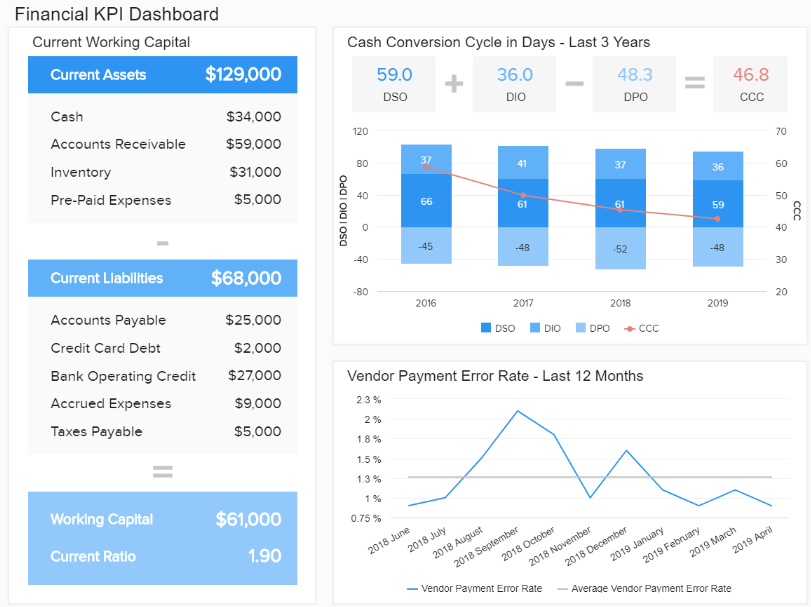

As an example suppose the average accounts receivable days outstanding three years ago was 38 days.

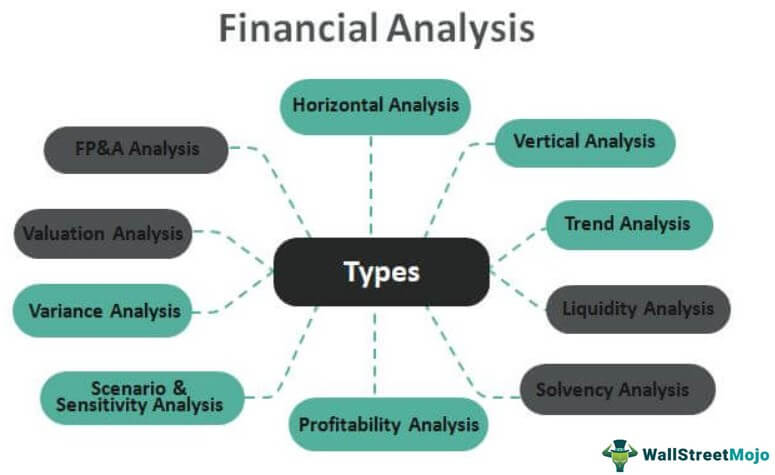

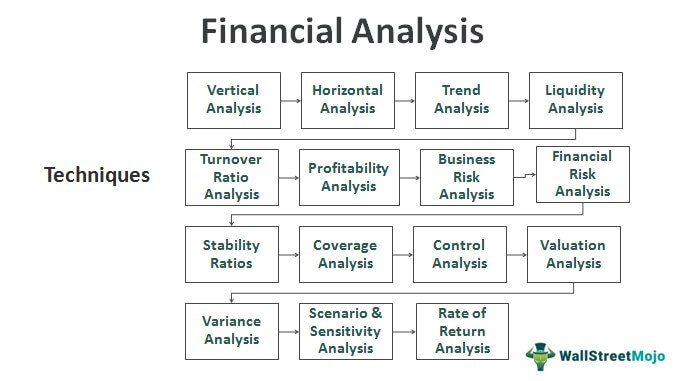

. At this stage you find trends correlations variations and patterns that can help you answer the questions you first thought of in the identify stage. Financial services products are bought and sold based on information about costs returns and risks. Financial Statement analysis embraces the methods used in assessing and interpreting the results of past performance and current financial position as they relate to particular factors of interest in investment decisions.

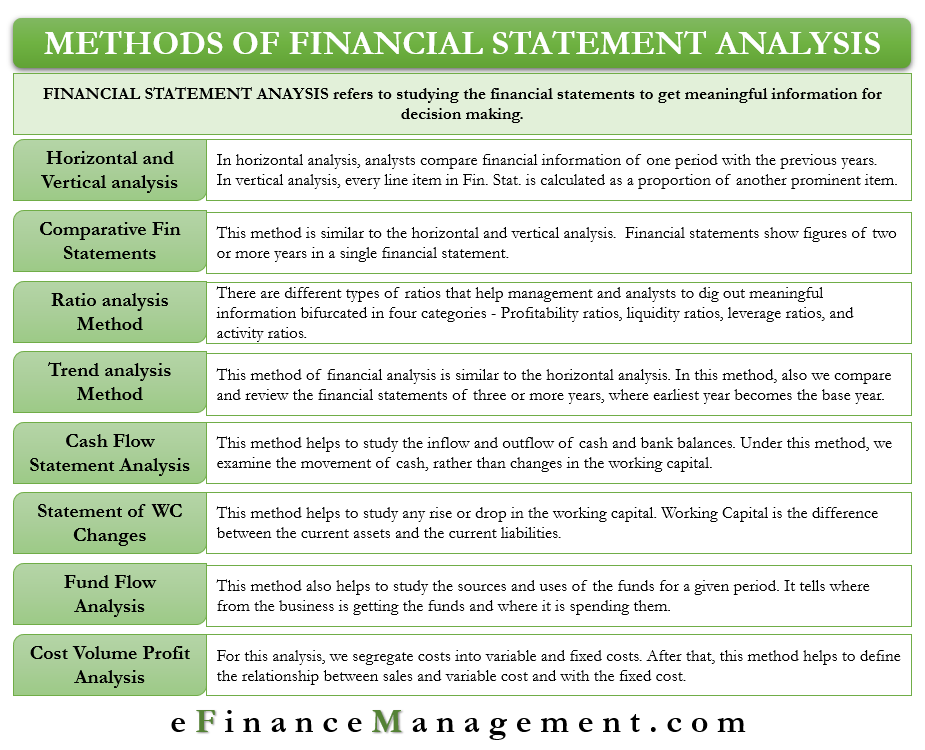

These tools and techniques can especially be useful when reviewing a companys financial data over time time-series analysis vis-a-vis the performance of other companies cross-sectional analysis. The figure to be used as 100 per cent will be total assets or total liabilities and equity capital in the case of balance sheet and. The first method is the use of horizontal and vertical analysis.

Working Capital Management 7. Customer analysis can seem like a daunting task. Regression is one of the most popular types of data analysis methods used in business data-driven marketing financial forecasting etc.

Funds Flow Analysis 4. With the help of various techniques such as statistical analysis regressions neural networks text analysis and more you can start analyzing and manipulating your data to extract relevant conclusions. There are many of these proven business analysis problem-solving techniques to choose from.

There are several tools and techniques which may be used when evaluating a companys financial status. Businesses rely on accurate financial information to make sound decisions. Identifying who your customers are.

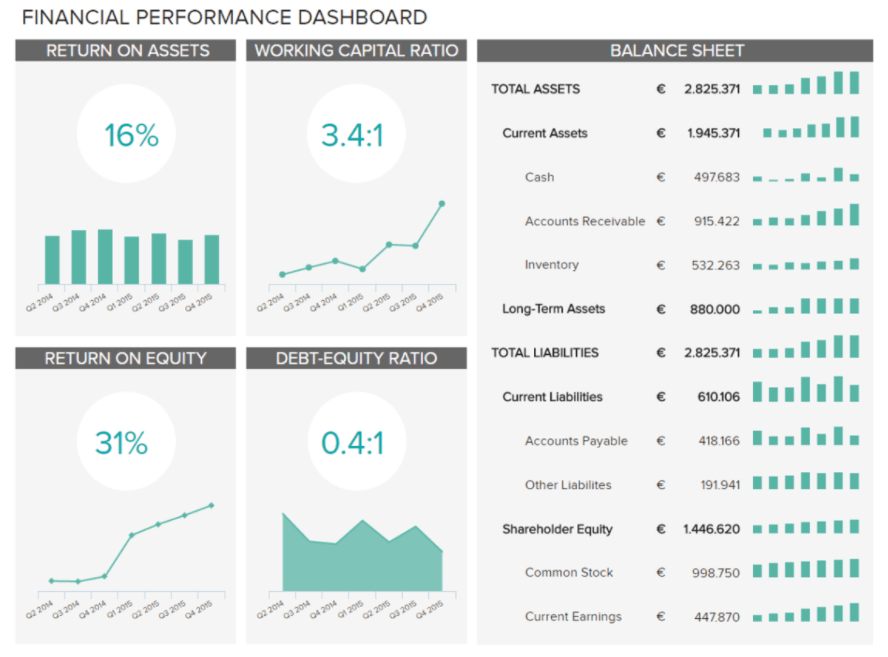

Vertical analysis sets a total figure in the statement equal to 100 percent and computes the percentage of each component of that figure. There is a huge range of different types of regression models such as linear regression models multiple regression logistic regression ridge regression nonlinear regression life data regression and many many others. Sensitivity Analysis is a tool used in financial modeling to analyze how the different values for a set of independent variables affect a dependent variable as a way of measuring risk.

Creating a profile of your ideal customer s. Still the ones highlighted here are the more commonly used methods and its reasonable to infer that their popularity stems from their effectiveness. The most popular way to analyze the financial statements is computing ratios.

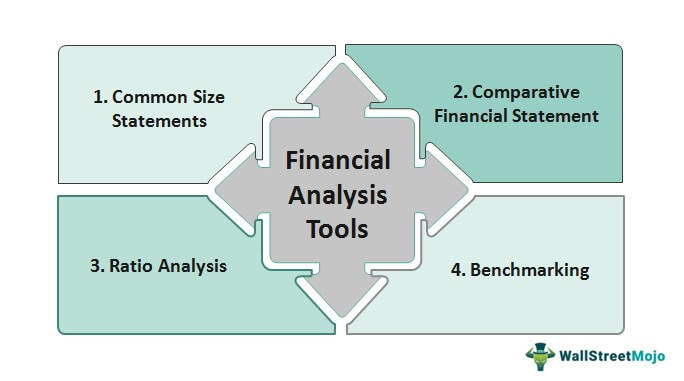

Financial information includes raw data records and reports. Customer analysis typically moves through the following stages. Summary Financial analysis techniques including common-size financial statements and ratio analysis are useful in summarizing financial reporting data and evaluating the performance and financial position of a company.

These tools and techniques include financial ratios. These include comparisons for profit margins liquidity turnovers and financial leverage. The important techniques of financial management are summarized as follows- 1.

Consumers are essentially buying information when dealing with financial services providers. Vertical Analysis uses percentages to show the relationship of the different parts to the total in a single statement. It is an important and widely used tool of analysis of financial statements.

Financial Statement Analysis is an analysis which highlights important relationships in the financial statements. Business Process Modeling BPM Brainstorming. Since the task of building a model to value a company is an attempt to predict the future it.

Horizontal analysis compares the ratios from several years of financial statement side by side to detect trends. Describe how ratio analysis and other techniques can be used to model and forecast earnings. Here is the list of top ten business analysis techniques.

Horizontal analysis is the comparison of financial information over a series of reporting periods while vertical analysis is the proportional analysis of a financial statement where each line item on a financial statement is listed as a percentage of another item.

Methods Of Financial Statement Analysis All You Need To Know

What Is Financial Reporting And Analysis Learn Its Importance

Tools Of Financial Analysis Common Size Statements Trend Analysis Etc

Types Of Financial Analysis List Of Top 10 Financial Analysis

Financial Analysis Tools Top 4 Tools Used For Analysis

Tools Or Techniques Of Financial Statement Analysis

How Financial Statement Analysis Helps Business Grow

Objectives Of Financial Statement Analysis Top 4 With Example

Comments

Post a Comment